Rates As Low As:

*APR = Annual Percentage Rate

Join Our Community

Philanthropy is at the top of our list as we strive to partner with our communities and give back with any opportunity that we can. This is reflected not just in what we pay back to our members, but all we do for the areas around us. As a credit union, it is our duty and responsibility to look after and support, not just our members, but also the communities that they work and reside in. Whether it’s a festival downtown or our annual golf tournament, we thrive on being able to connect with our community. MC Federal truly enjoys volunteering and helping charities and foundations as much as we can. We have a wonderful group of employees who volunteer their own time and are proud to represent our credit union.

Our growth over the years is a sign of confidence in the strength and security that our members have come to expect. In addition to peace of mind, we offer great service built upon the credit union philosophy of “people helping people.” Our corporate values drive every decision we make. The trust between us and our members encapsulates our mission statement to be the catalyst that positively impacts the financial health and well-being of our members and the communities we serve. Given our strong values and commitment to community, MC Federal Credit Union is expanding opportunities for membership to better serve our communities.

News & Events

Connecting with our community—right where they are.

More Articles You May Like

Building Financial Confidence: Shamokin Getting Ahead Graduates Recognized

MC Federal Credit Union is proud to celebrate the latest

Webinar: Strategies For Successful Saving

Do your financial goals include saving more money? Whether it’s

MC Federal Credit Union Expanding with New Berwick Branch

We’re excited to share that MC Federal Credit Union is

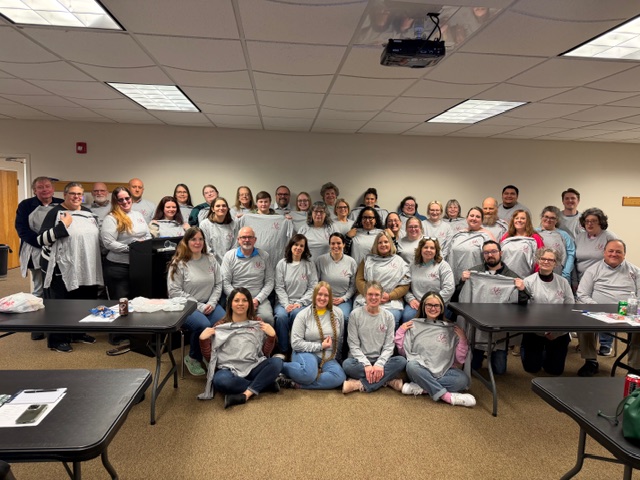

Growing Together: Another Successful MC Federal Training Day

Yesterday, the MC Federal team came together for another impactful

Supporting local businesses and connecting with their teams is what we do best.

Our Branch Managers recently spent time onsite at Prima Pizza

Honoring Janet Williams’ 31 Years at MC Federal Credit Union

We extend our heartfelt congratulations to Janet Williams on her